Business planning

Now it's fast

Build your financial model without spreadsheets.

Formulas are embedded — just click.

See Feo in action

in 2 minutes

How Feo works

1

Choose yourtype of business

For example, a café or an IT start-up. Every single parameter entered is taken into account.

2

Change dataas you like

All calculation formulas are already embedded in the model. You only need to enter revenues, costs, etc. If something goes wrong, Feo will correct you.

3

Get yourfinancial model

The generated financial model shows you whether the planned business is profitable. You will also be provided with all important documents for an investor or a bank.

You will get

a full financial model with a presentation

When you are done...

Just download a PDF or share a link

Feo suits your needs

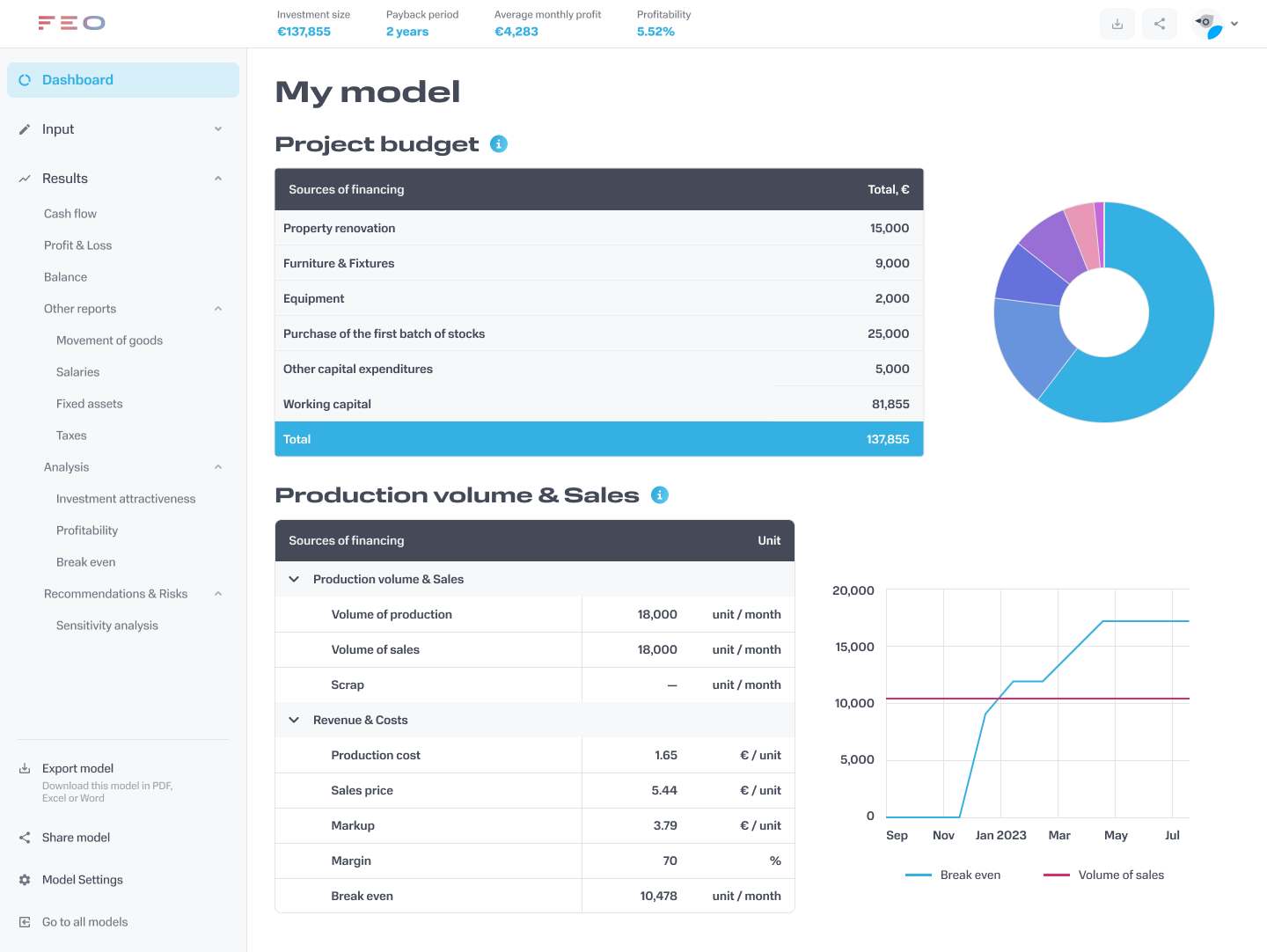

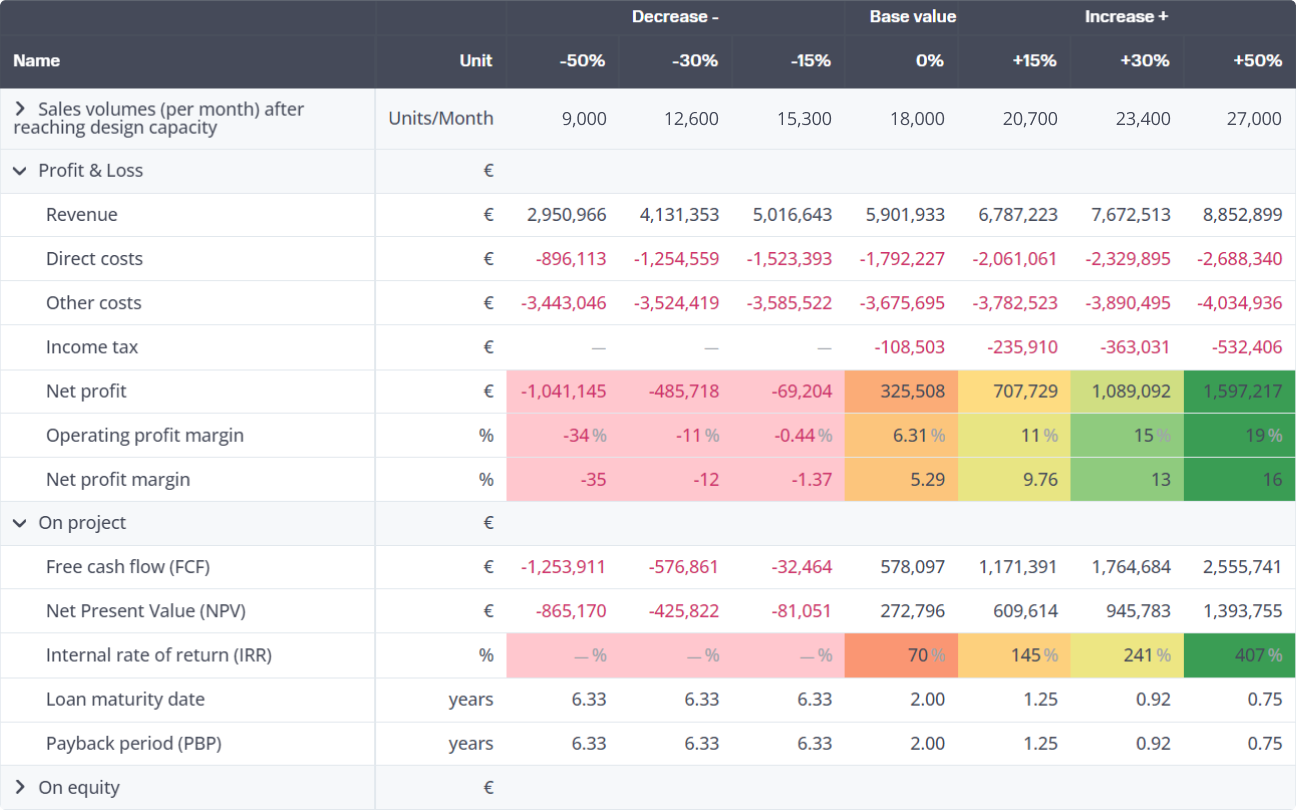

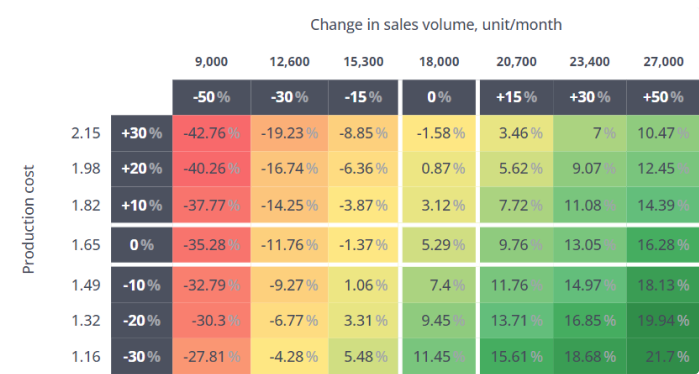

Do you have a business idea and want to calculate profit and payback period?

Choose your business template, customize the data for your project and get all the results you need.

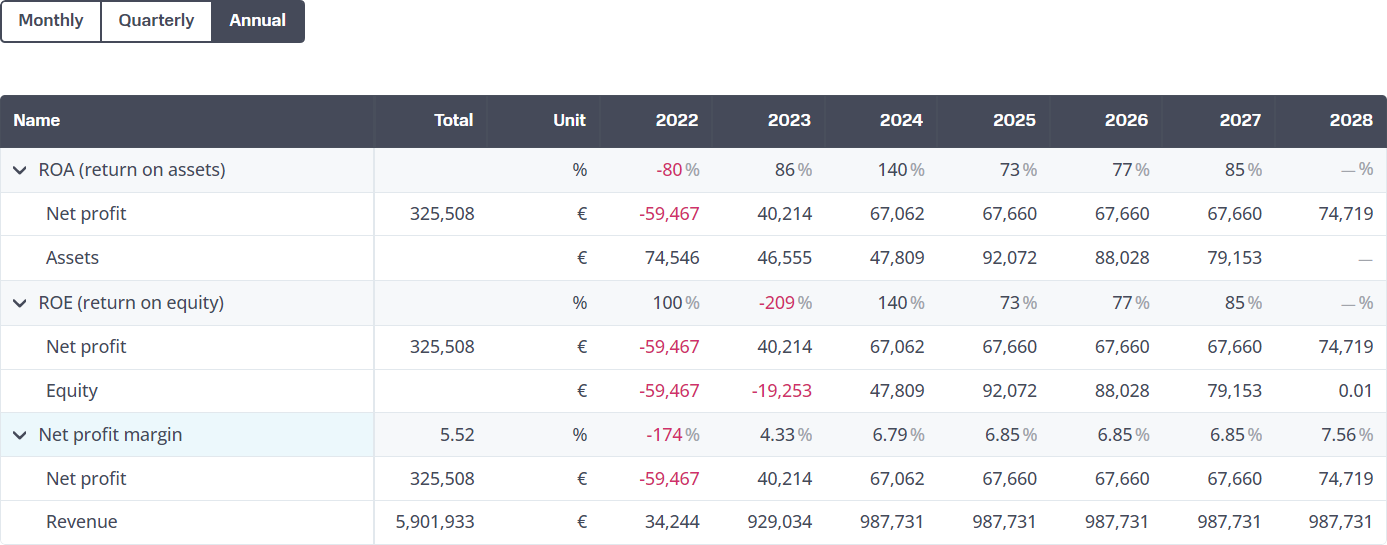

You will get a dashboard and all the necessary results, such as Cash Flow, Profit and Loss, analysis of investment attractiveness and much more.

Do you want to raise investments from an investor or get a loan from a bank?

Our financial models meet international requirements of investors, banks and other financial institutions.

Calculate your financial model and share the results with an investor or a partner in 1-click.

Do you think that creating a financial model is very difficult and expensive?

Now it`s easy. No more spreadsheets.

Our models contain formulas to calculate all necessary indicators, including taxes, credits and loans.

Customize the initial data — the rest will be done by Feo.

We compiled many templates of financial models based on the existing successful businesses.

We have many features to make your business grow faster

All your data is secure

Track-Record of Feo

12 years

Experience in corporate finance and technology

1,200+

Financial models

$ 750 million

Total budget of the projects

500+

Approved loan applications

Feel your business

In just a couple of steps without large spreadsheets or intense courses.